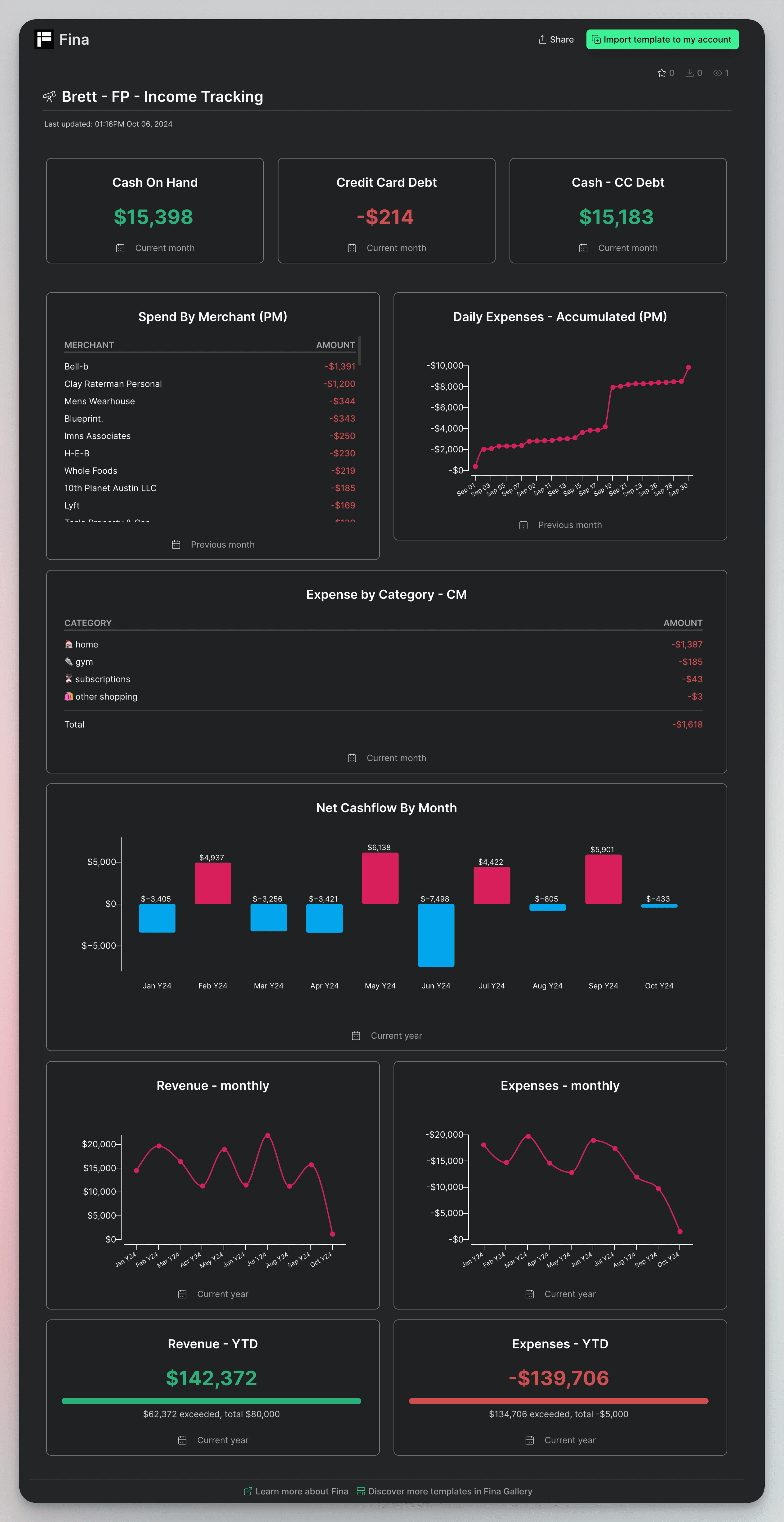

Brett - FP - Income Tracking

The "Brett - FP - Income Tracking" template provides a detailed view of both income and expenses, helping users keep track of cash flow, credit card debt, and spending by merchant. With daily expenses charts and monthly revenue and expenses overviews, users can gain better insights into their financial patterns. This template is ideal for users who want to monitor their income, spending, and overall financial health on a monthly and yearly basis.

Purpose:

This template enables users to track their daily expenses, credit card debt, cash flow, and merchant-specific spending. It also gives a detailed monthly and yearly view of revenue and expenses, making it easier to manage income, control expenses, and maintain a healthy balance between cash on hand and debt.

How to Use This Template:

Import the Template to Your Fina Account:

Begin by importing this template into your Fina account to start tracking your income and expenses immediately.Monitor Cash and Debt:

The "Cash On Hand" and "Credit Card Debt" sections provide an overview of your current financial status, showing the cash you have available and any outstanding credit card balances.

Track Spending by Merchant:

Use the "Spend by Merchant" block to see where your money is going. It breaks down expenses by individual merchants, helping you identify areas where you can cut costs.

Analyze Daily and Monthly Expenses:

The "Daily Expenses - Accumulated" chart shows how your spending adds up over the month. Use this to spot any significant increases or patterns in your daily expenses.

The "Expense by Category" section organizes your expenses by key categories such as home, gym, and subscriptions, giving you a clear view of where your money is being spent.

Monitor Cash Flow and Revenue:

The "Net Cashflow by Month" block shows your net cash flow, helping you understand the difference between your income and expenses over time.

The "Revenue - Monthly" and "Expenses - Monthly" charts provide a visual representation of your financial activity, while the YTD (Year-to-Date) sections give an overall picture of your yearly financial performance.

Tips:

Stay Updated:

Make sure to regularly update the merchant spending and category expenses to keep your financial information current.Use Cash Flow Insights:

Use the cash flow and net income sections to adjust your spending habits if needed, ensuring you stay on track with your financial goals.Keep an Eye on Debt:

Monitor your credit card debt closely, and use the cash flow and revenue insights to make timely payments and avoid unnecessary interest.

With the "Brett - FP - Income Tracking" template, users can easily manage their income, monitor expenses, and stay on top of their financial situation by tracking cash flow, spending habits, and merchant-specific expenses throughout the year.