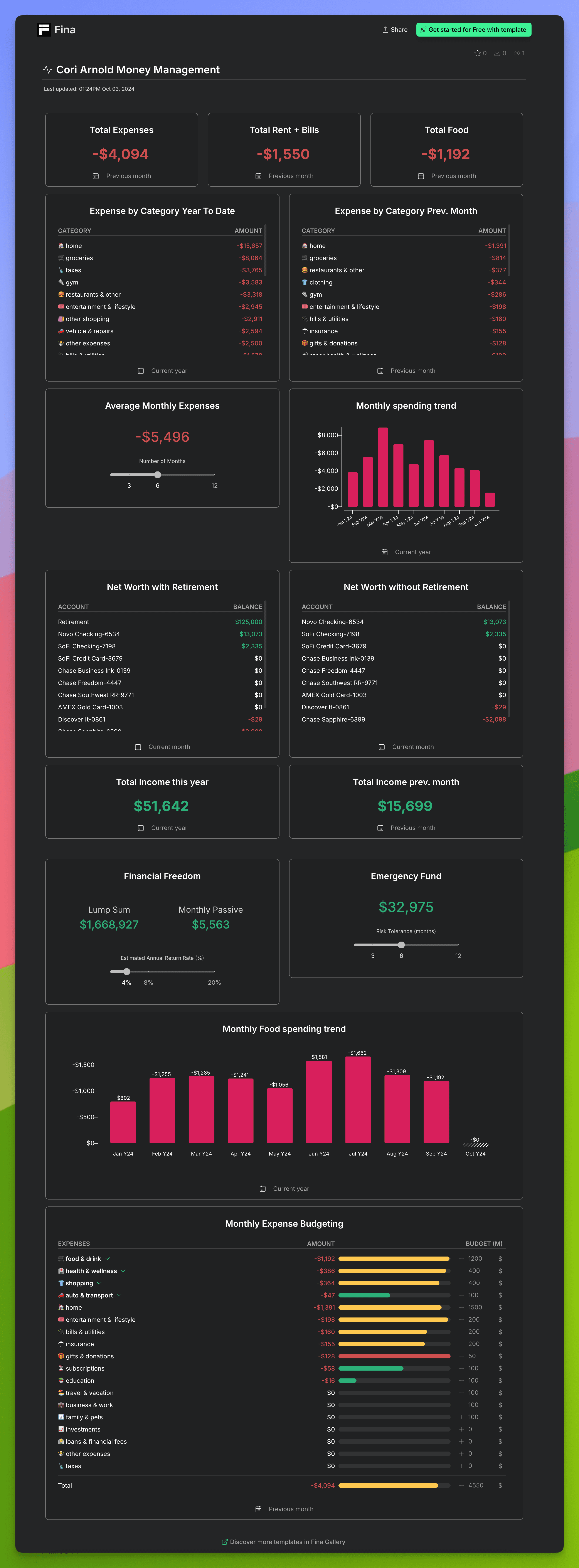

Cori Arnold Money Management

The "Cori Arnold Money Management" template is designed to provide a comprehensive overview of personal finances, allowing users to effectively track their expenses, income, and net worth. With a breakdown of expenses by category, monthly spending trends, and net worth (with and without retirement), this template helps users manage their finances with clarity and precision. It’s perfect for individuals looking to monitor their overall financial health and make data-driven decisions about budgeting, saving, and spending.

Purpose:

This template helps users track their year-to-date and previous month’s expenses by category, giving a detailed look at where their money is going. It also includes a section for monitoring net worth, both with and without retirement accounts, and provides insights into financial freedom and emergency fund status. The "Monthly Expense Budgeting" section ensures that users can stay within their set budget for key spending categories, making it easier to manage finances month-over-month.

How to Use This Template:

Import this template to your Fina account.

Track Expenses by Category:

The "Expense by Category Year to Date" and "Expense by Category Prev. Month" blocks give a detailed breakdown of where your money is being spent. Use this to adjust your budget or identify areas where you can save more.

Monitor Net Worth:

View your net worth with and without retirement accounts to get a clear understanding of your overall financial situation. Regularly update these sections with account balances to ensure accuracy.

Set and Monitor Financial Goals:

Use the "Financial Freedom" section to estimate how much you need in a lump sum or passive monthly income to achieve financial independence.

Track your emergency fund to ensure you have enough savings to cover expenses for 3, 6, or 12 months based on your risk tolerance.

Analyze Spending Trends:

The "Monthly Spending Trend" and "Monthly Food Spending Trend" charts help you track how your spending fluctuates throughout the year. Adjust your spending habits accordingly to stay on track with your financial goals.

Budget for Expenses:

In the "Monthly Expense Budgeting" section, set a budget for each category and track your actual spending against these amounts. This allows for better control over your monthly expenses.

Tips:

Regularly update your income and expense categories to reflect any changes in your financial situation.

Use the spending trend analysis to identify months where you overspend and adjust your budget accordingly to avoid future shortfalls.

Take advantage of the emergency fund tracker to ensure you are financially prepared for any unexpected expenses.

With the "Cori Arnold Money Management" template, users can gain a holistic view of their finances, helping them stay on top of their financial health and work toward financial freedom.