Using Different Budgeting Methodologies in Fina

This template allows users to explore and apply multiple budgeting approaches within their personal finance management, including:

Zero-Based Budgeting:

A method where every dollar is accounted for, leaving no money unassigned. The goal is to ensure your income minus your expenses equals zero.50/30/20 Budgeting (Percentage-Based):

This method breaks down your income into three categories:50% for Needs

30% for Wants

20% for Savings/Paying off Debt

Reverse Budgeting:

Focuses on prioritizing savings first by determining your savings goals, and then allocating the rest of your budget to cover needs and wants.The 60% Solution:

This is a simplified budgeting method where 60% of your income goes toward committed expenses (e.g., rent, utilities, groceries), and the remaining 40% is split into categories like savings, retirement, and discretionary spending.

Template Features:

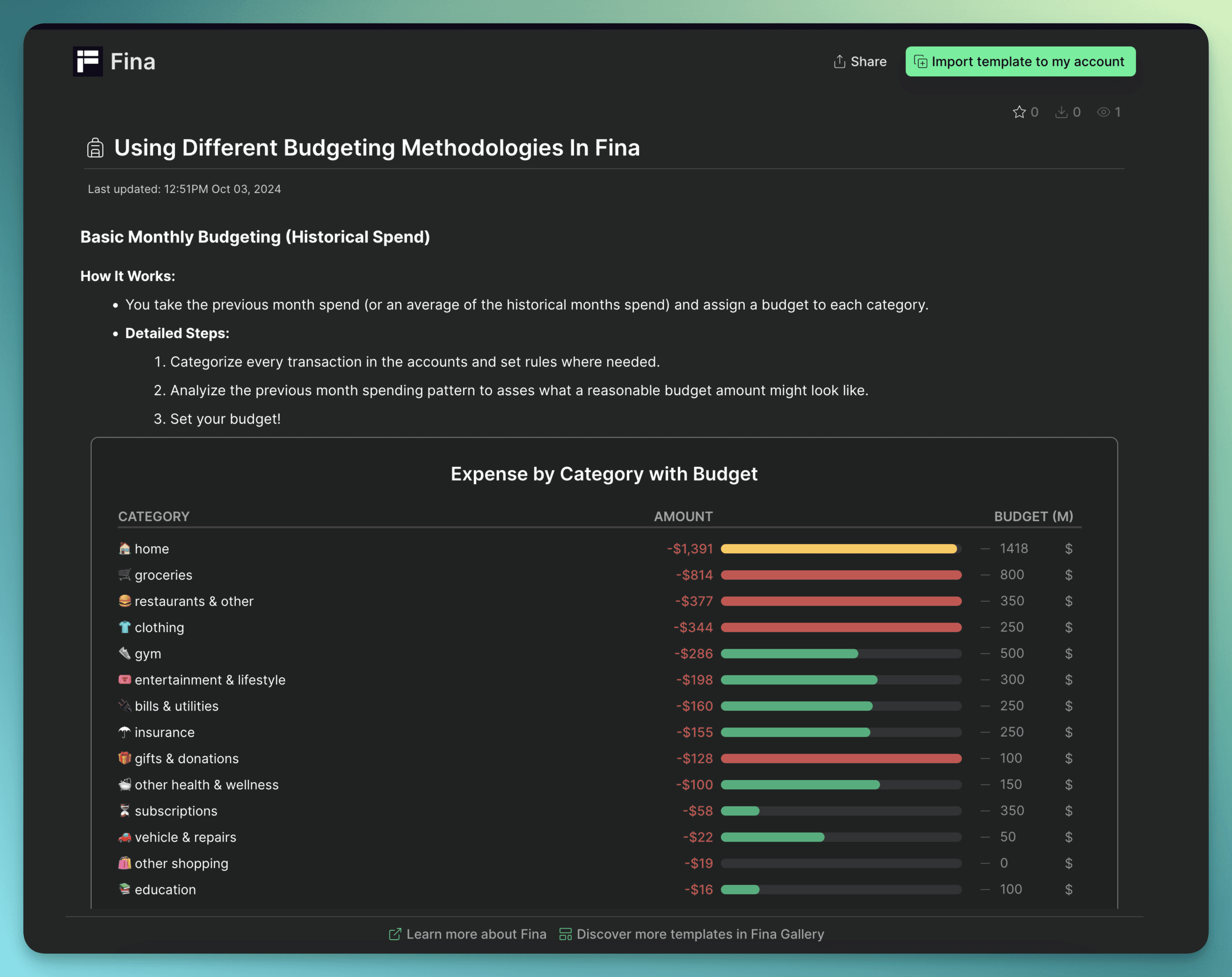

Expense by Category with Budget:

The dashboard provides an overview of your expenses categorized by needs, wants, and savings. Each budget methodology calculates different ways of managing your income, tailored to your goals.Adjustable Budget Goals:

Users can set personalized monthly spending caps or savings targets and visualize whether they’re meeting those goals using bar charts and progress trackers.Financial Goal Trackers:

It includes goal-setting sections for:Emergency fund

Financial freedom number (lump sum and monthly passive income)

Income allocation by percentages, such as 50/30/20 or 60% method.

How to Use This Template:

Import the Template:

After importing this template, you can track your income, expenses, and savings goals based on your chosen budgeting style.Customize Categories:

You can edit each block to change the income/expense categories to match your personal finances.Track Progress:

Use the graphs and tables to monitor your budget over time, and adjust spending as needed to hit your financial targets.

This template is perfect for individuals trying out different budgeting methods to see what works best for their lifestyle and financial goals.