Minh Chau's Financial Flow Template

The "Minh Chau’s Financial Flow" template provides a comprehensive monthly financial overview that tracks income, expenses, budgeting, and progress toward financial goals. With sections for expense breakdowns, budgeting insights, income tracking, and financial goals like emergency savings and financial freedom projections, this template is designed to help users stay on top of their finances with clarity and structure. Ideal for individuals looking to monitor both their short-term spending habits and long-term financial health, this template brings detailed tracking and strategic planning together in one view.

Purpose: This template assists users in monitoring their monthly cash flow, providing insights into both income and expenses. It includes breakdowns by category for detailed expense management, and it offers goal tracking sections for emergency savings and financial freedom. By regularly updating these sections, users can ensure they are staying within budget and working toward their long-term financial objectives.

How to Use This Template:

Track Monthly Summary:

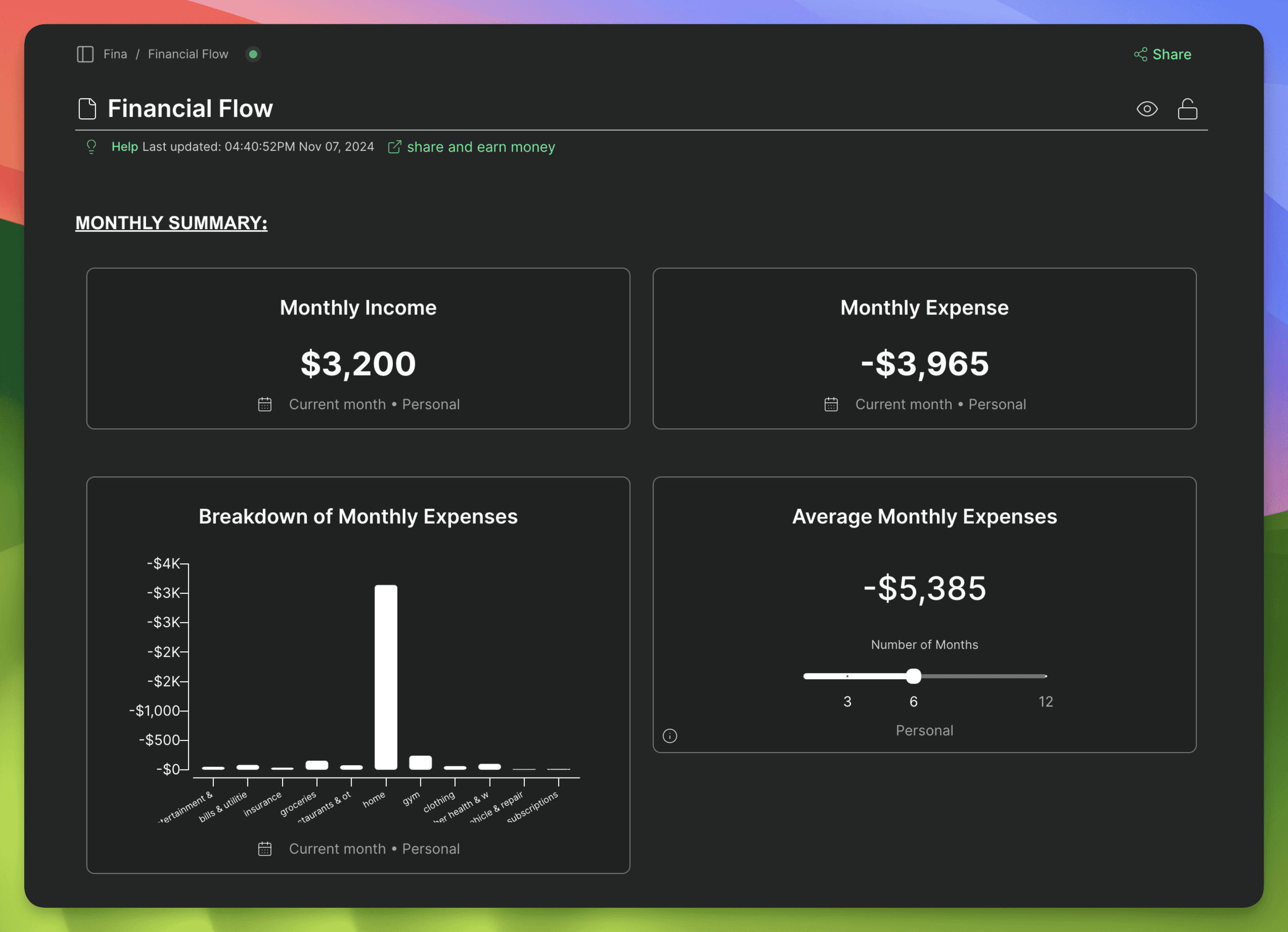

Use the "Monthly Income" and "Monthly Expense" sections to see a snapshot of the current month’s income and expenses.

Refer to the "Breakdown of Monthly Expenses" and "Average Monthly Expenses" blocks for a detailed view of spending, making it easier to identify areas for cost-cutting or increased savings.

Manage Expenses and Budgeting:

In the "Monthly Budgeting" section, categorize each expense and compare against set budget limits. The "Monthly Expenses YoY" chart helps visualize year-over-year spending trends.

Regularly review this section to ensure you are staying within your desired budget across various expense categories.

Monitor Income:

The "Total Income YTD" graph and "Income by Category" table provide a breakdown of your income sources, helping you assess whether you are on track to meet yearly income goals.

Set and Track Financial Goals:

Utilize the "Emergency Fund" and "Net Worth YTD" sections to track progress toward essential financial goals.

The "Financial Freedom" section allows you to project the amount needed in both lump sum and passive monthly income to achieve financial independence. Adjust the estimated annual return rate as needed to see different scenarios.

Tips:

Regularly update each section with your latest income and expense data to get an accurate picture of your financial situation.

Use the "Monthly Budgeting" section to set and adjust spending limits, ensuring you stay within budget across all categories.

Leverage the "Financial Freedom" section to set realistic long-term goals, adjusting as your financial situation evolves.

With "Minh Chau’s Financial Flow" template, you can effectively manage your finances by tracking monthly income, expenses, and budgeting, while also planning for long-term financial freedom. This structured approach helps you make informed financial decisions and stay on track with your personal financial goals.