Collaborate with Partners or Clients

Many ways to share

Fina allows you to share your account with guests, making it easy to collaborate with partners or clients on financial management. You can share your account in several ways:

-

Share a page: when you build a Fina page with insights, you can share it with anyone by sending them the page link. They can view the page without needing to log in to Fina if it's public accessible.

-

Share a category snapshot: setting up categories reflects your financial tracking phylosophy. You can share a category snapshot with anyone by sending them the link. This is a great way to show your financial tracking philosophy to potential clients or partners.

-

Share account access: if you want to give someone full access to your Fina account, you can invite them as a guest. Guests can view or edit your account, but they won't be able to change your password or delete your account.

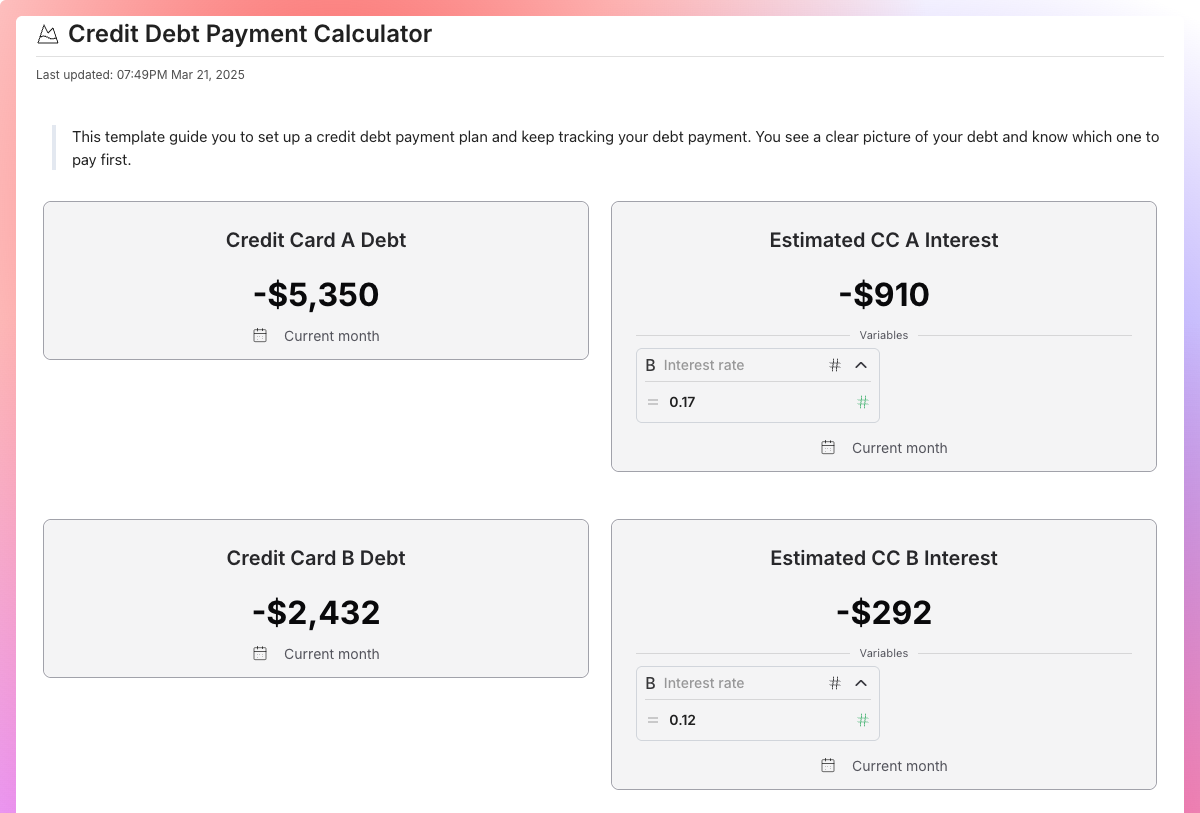

Debt Template:

Debt Template: