How Financial Tracking and a Finance Tracker Can Change Your Life

In today’s fast-paced world, managing your money wisely isn’t just a good habit—it’s essential.

Whether you're saving for a big purchase, building an emergency fund, or simply trying to get through the month without stress, financial tracking can make all the difference. And picking the right finance tracker can simplify it to become more efficient and more effective.

What Is Financial Tracking?

At its core, financial tracking means keeping a detailed record of your income, expenses, debts, and investments.

It’s about understanding where your money comes from, where it goes, and how you can optimize it to meet your goals. Instead of guessing how much you spent on groceries last month or wondering why your savings aren’t growing, financial tracking gives you real answers.

Modern tools like Fina Money make this process easier than ever. With features like data sync with finance institutes, automatic categorization, real-time updates, and visual dashboards, you can see your financial picture at a glance.

By staying aware of your spending habits, you can spot areas where you might be overspending, identify opportunities to save, and make smarter financial decisions overall.

Why You Need a Finance Tracker

While you can track finances manually with a notebook or spreadsheet, a good finance tracker simplifies everything. These tools automatically categorize your expenses, visualize your cash flow, and even alert you when you're close to overspending.

Some key benefits of using a finance tracker include:

- Better Budgeting: Easily set and stick to budgets for different categories like groceries, entertainment, and travel.

- Saving Smarter: See exactly how much you can realistically save each month.

- Reducing Debt: Keep an eye on debt repayments and track progress toward being debt-free.

- Less Stress: With all your financial information in one place, money management feels less overwhelming.

Choosing the Right Finance Tracker

Not all finance trackers are the same. When choosing one, look for features like:

- Bank syncing for real-time updates.

- Customizable categories for spending.

- Visual dashboards for quick insights.

- Goal setting and progress tracking.

- Strong privacy and security measures.

- AI-assistance for ease of use.

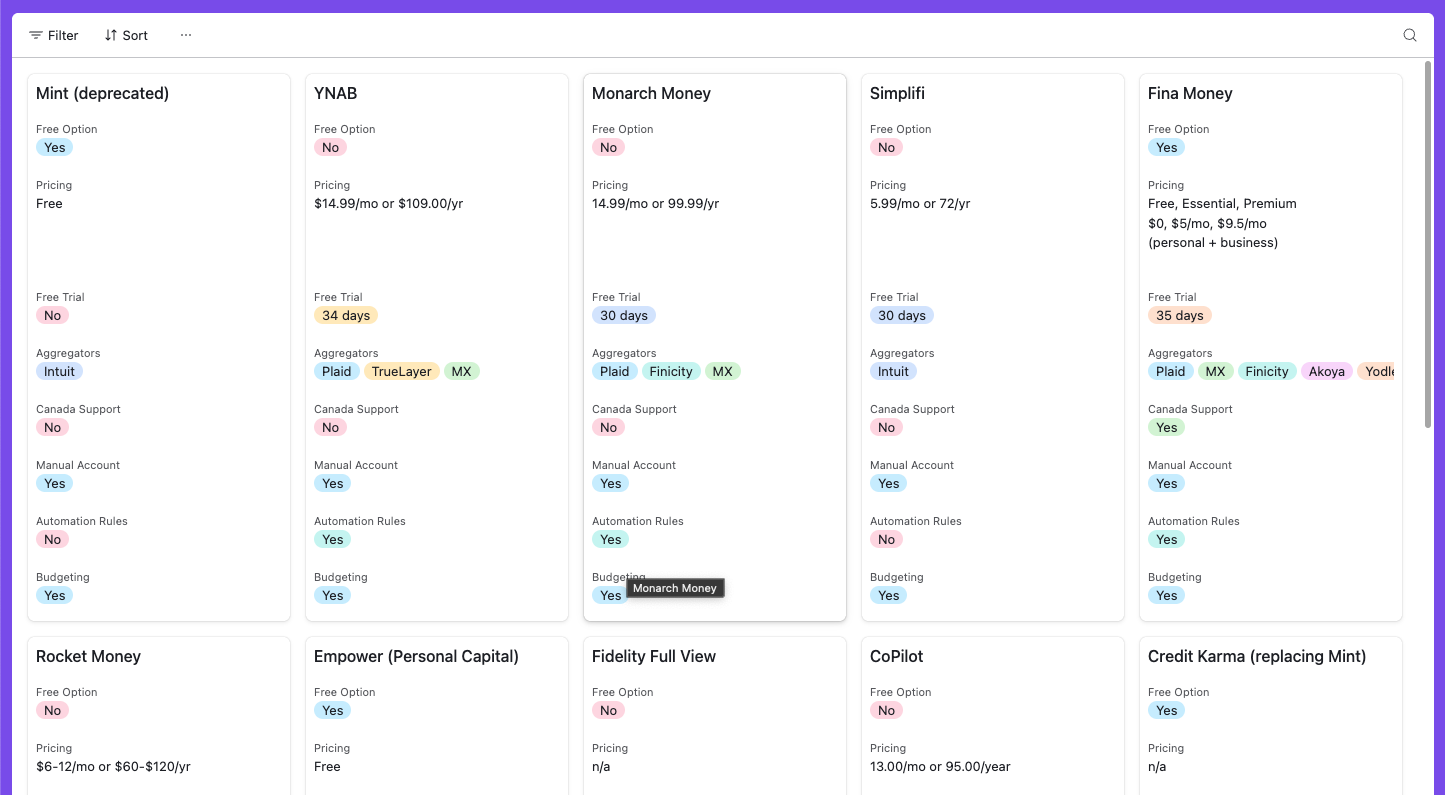

Some popular options include apps like Mint, YNAB (You Need a Budget), Monarch Money and newer tools like Fina Money, which blend AI-powered categorization with human-friendly design.

To make it easy for you, by manually collecting all the available information, we’ve compiled a list of the best finance trackers available today. You can check it out from here @ airtable.

Finance Trackers: https://airtable.com/appEKJfNrmWh5VJAd/shrU8fyIp1TUSjcuE

Finance Trackers: https://airtable.com/appEKJfNrmWh5VJAd/shrU8fyIp1TUSjcuE

How to Start Financial Tracking Today

Starting is easier than you think. Here’s a simple plan:

- Pick a Tool: Choose a finance tracker that suits your style and goals.

- Link Accounts: Connect your bank accounts, credit cards, and investments.

- Set Your Categories: Customize categories that reflect your lifestyle.

- Track and Review: Check your tracker weekly to monitor your progress.

- Adjust as Needed: Update your budgets and goals as life changes.

The key is consistency. Financial tracking isn’t a one-time task—it’s an ongoing habit that can set you up for financial freedom. If you are interested in learning about Fina Money, check out its official demo from its homepage.

Conclusion

Taking control of your finances doesn’t have to be complicated. With financial tracking and a reliable finance tracker, you can build a healthier relationship with money, achieve your financial goals faster, and create a more secure future.

Start today, and your future self will thank you.